A data-driven approach to diversifying Ireland's tourism markets in response to current challenges

April 2025

CSO data shows a consistent decline since September 2024, with February 2025 seeing the steepest drop yet.

"Last week data from the CSO showed a decline of 30 per cent in the number of visitors to the country in February, with revenue taking a hit of €88 million during the month." - Inside Business Podcast

| Month | 2024 (000s) | 2025 (000s) | Change (%) |

|---|---|---|---|

| January | 451.9 | 338.9 | -25% |

| February | 433.3 | 304.3 | -30% |

The CSO introduced a new "Inbound Tourism Series" during COVID-19, which uses different methodology, making it difficult to compare current numbers with pre-pandemic data.

Significant drop in US visitors, which traditionally provide high-value tourism revenue. February 2025 saw only 31,200 US visitors, down from 46,600 in February 2024.

Geopolitical tensions and economic pressures are causing travelers to reconsider long-haul destinations, with closer, more affordable options gaining preference.

Tourism operators like Sean Connick (Dunbrody Famine Ship Experience) report significant increases in operating costs alongside declining visitor numbers.

Ireland is increasingly perceived as an expensive destination compared to other European countries, particularly for accommodation and food.

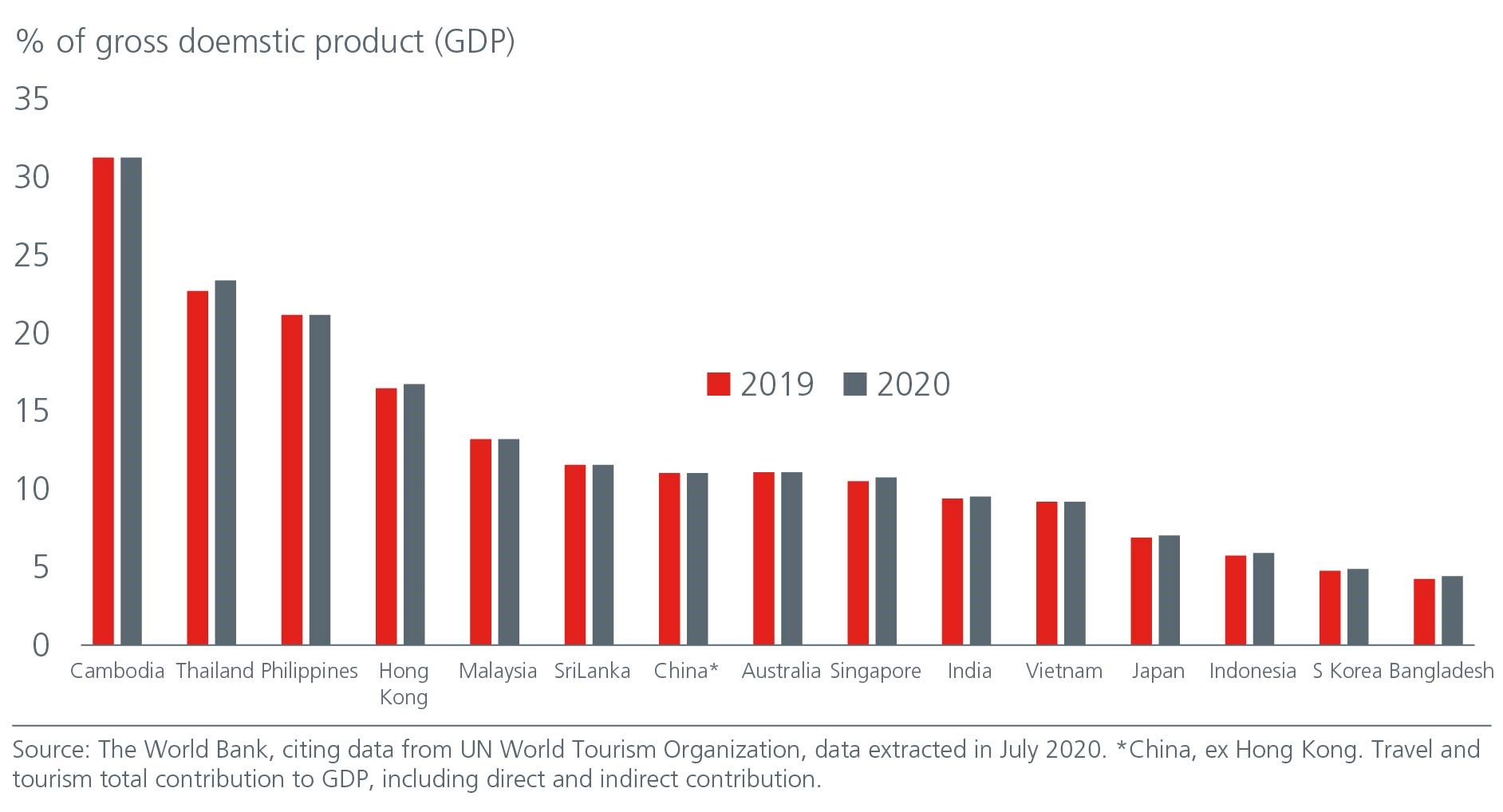

Over-reliance on traditional markets (UK, US, and Western Europe) has left Ireland vulnerable to shifts in these markets. Asian visitors account for less than 5% of total tourism.

Eoghan O'Mara Walsh (CEO) believes CSO figures may be overstating the decline. Industry data for hotels and attractions shows a more positive picture than official statistics suggest.

Operators like Sean Connick are experiencing real declines with "soft" numbers in January and February 2025, and increasing operational costs affecting profitability.

April 2025 US Tariff Implementation

"Last year, Ireland exported €72bn worth of goods to the US. So a 20% tariff is huge. It could have been worse."

While pharmaceuticals have temporarily avoided the 20% tariff, they remain a stated target for future action.

The double impact of tourism decline and trade tariffs creates significant economic pressure on Ireland, especially in:

Pharmaceuticals dominate Irish exports to the US:

"Ireland and Europe has a larger trade deficit with the US and that's the crudeness through which this has been calculated."

Ireland's tourism industry is particularly exposed to shifts in the North American market:

"We are very exposed to the North American market." - Tourism Industry Executive, Irish Times, April 2025

Ireland's economy is disproportionately exposed to US policy changes, with both trade and tourism vulnerable to the same economic and political factors.

US tourism is highly seasonal, creating boom-bust cycles in tourism areas, with limited visitors during off-peak periods.

Rural communities and small towns that rely on either tourism or pharmaceutical manufacturing are doubly exposed to US market changes.

Asian visitors currently represent a tiny fraction of Ireland's tourism market:

Asian visitors to Ireland (percentage of total visitors)

Asian economies are showing strong post-pandemic growth, with domestic consumption and outbound travel rebounding faster than Western markets.

Asia's middle class is projected to reach 3.5 billion by 2030, creating an enormous new travel market with disposable income for international tourism.

Asian tourists are increasingly seeking authentic cultural experiences and are venturing beyond traditional European destinations like Paris and Rome.

Asian tourism patterns can help fill Ireland's off-season periods, as many Asian tourists prefer to travel during different times than traditional Western markets.

"According to Tourism Ireland, the number of Chinese tourists visiting Ireland could reach 200,000 in 2025, more than double that in 2017."

| Source Market | Current Visitors (est.) | 2030 Potential | Growth Opportunity | Spending Potential |

|---|---|---|---|---|

| China | 100,000 | 250,000 | +150% | €375 million |

| India | 30,000 | 300,000 | +900% | €450 million |

| Japan | 25,000 | 100,000 | +300% | €150 million |

| South Korea | 15,000 | 75,000 | +400% | €112 million |

| Other Asia | 30,000 | 125,000 | +317% | €188 million |

| Total | 200,000 | 850,000 | +325% | €1.275 billion |

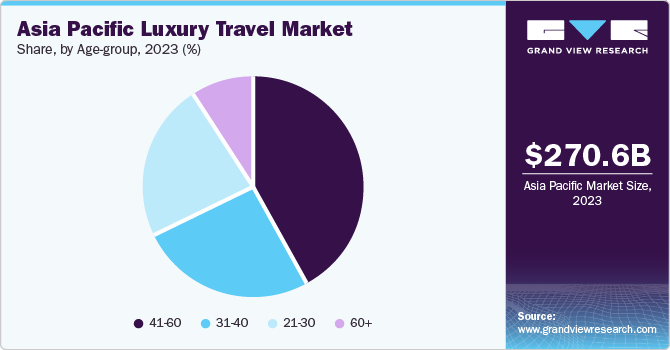

Chinese travelers are strongly interested in premium experiences and quality products that they can showcase back home.

Asian tourism patterns can help fill Ireland's tourism calendar during traditionally quieter months, reducing seasonality issues.

Asian visitors often share their travel experiences extensively online, creating organic marketing and inspiring others to visit.

Chinese tourists often travel in groups for safety and convenience, but younger travelers increasingly opt for independent travel. Indian families frequently travel together, often in multi-generational groups.

Modern Asian tourists are increasingly interested in authentic cultural experiences rather than simply checking off landmarks. This aligns perfectly with Ireland's rich cultural heritage offerings.

Asian travelers expect excellent Wi-Fi and digital services. They rely heavily on mobile payments, online bookings, and digital guides in their native languages.

With increasing urbanization in Asia, tourists are showing greater interest in natural landscapes and outdoor experiences, making Ireland's scenic countryside particularly appealing.

Asian tourists, especially when part of organized tours, visit a wider range of locations across Ireland:

Retail & Luxury Goods

Asian tourists spend significantly on shopping, particularly for luxury items, unique souvenirs, and local products.

Food & Beverage

Strong interest in local cuisine and food experiences, with higher than average spending in restaurants.

Premium Accommodations

Preference for 4-5 star hotels and unique accommodation experiences, driving higher RevPAR.

Cultural Attractions

High visitation rates to museums, cultural sites, and historical attractions, supporting preservation efforts.

Follow Tourism Ireland's initiative to double marketing efforts in China and expand similar approaches to India, Japan, and South Korea.

Negotiate with key Asian carriers for direct flights to Dublin, or convenient one-stop routes with partner airlines.

Build upon the success of the five-year multiple-entry visa for Chinese nationals by extending similar programs to Indian and other Asian travelers.

Develop presence on WeChat, Weibo, LINE, and other Asian social platforms with culturally relevant content.

Create virtual tours and 360° experiences of key Irish attractions, optimized for Asian mobile platforms.

Collaborate with popular Asian travel influencers to showcase authentic Irish experiences to their millions of followers.

Develop multilingual materials, signage, and guides in Mandarin, Hindi, Japanese, and Korean at major attractions.

Facilitate acceptance of WeChat Pay, Alipay, UPI, and other Asian payment platforms at key tourism businesses.

Develop training for tourism providers on Asian cultural norms, expectations, and service preferences.

Create high-end tourism products targeting affluent Asian travelers, including exclusive access experiences.

Develop specialized routes that align with Asian interests, such as pilgrimage itineraries, photography spots, movie locations, or literary connections.

Develop tax-free shopping programs and luxury retail experiences specifically targeting Asian visitors.

With proper development, Asian tourism could generate €1.2+ billion annually by 2030, helping offset potential losses from US market changes.

Asian tourism growth could create 10,000+ new jobs across Ireland, particularly benefiting rural areas and small towns.

Diversifying tourism sources provides resilience against geopolitical and economic challenges in any single market.

Different holiday patterns help distribute tourism throughout the year, improving business sustainability.

By pivoting strategically to Asian markets, Ireland can transform its current tourism challenges into a more diverse, resilient, and profitable tourism sector for decades to come.

Stay updated on our news and events! Sign up to receive our newsletter.